A Guide On Cryptocurrency Liquidity

SubscribeCryptocurrencies-“The alluring digital coins” are being traded over the successful exchange platforms by the investors to grab the market share of the cryptocurrencies. This increases the cryptocurrency liquidity exchange in the crypto world.

Here in this writing, we will guide you on cryptocurrency liquidity. Before looking into the entire guide, you need to know the basic term liquidity.

CryptoSoftwares has excellent cryptocurrency exchange software development services

What does Liquidity mean in Cryptocurrency?

The cryptocurrency liquidity is the capability of the crypto coin to be converted into physical money or cash.

Introduction to Liquidity

Besides market capitalization, liquidity plays a very important role in cryptocurrency trading and in making investments. Cryptocurrency liquidity exchange is the feature where the asset or the digital coins are quickly traded over the platform to convert them into physical money without affecting the current market value of the cryptocurrencies.

The most stable form of the liquid asset is cash where it can be accessed easily for making any purchase, returning the debts, etc. The liquidity of the asset is measured by cash or physical money.

One of the similarities among the liquid assets like stocks, currencies, bonds have an open market to trade. It means all the liquid assets can be traded globally on different platforms without affecting its current value or stable prices. It can make thousands of transactions by maintaining a stable value.

The illiquid assets or assets that do not have a similar platform need to be traded on private sales. The illiquid assets like Antiques, real estate, Art can vary in a huge margin and may not maintain its stable price value. It is very difficult to evaluate the exact price value of illiquid assets. If the asset is not easily converted into cash, then the asset is said to be an illiquid asset.

So it is understood that liquidity means the easy transformation of an asset to cash.

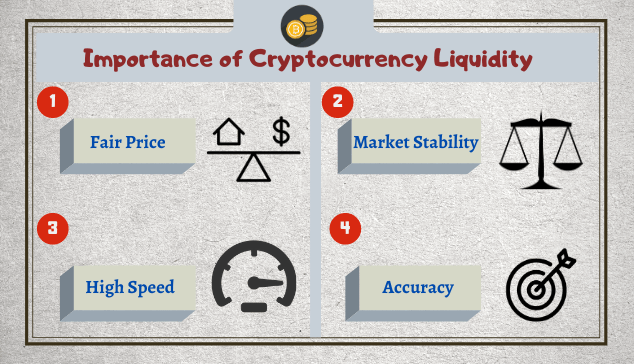

Importance of Liquidity

Liquidity is an important factor in trading cryptocurrencies. The higher the liquidity, the easier it is to trade the assets. High liquidity is preferred in the crypto market, which brings about below-mentioned benefits.

As you all know that the liquid market will consist of a huge number of buyers and sellers, it will benefit the market participants. Here the transactions will happen at ease and yield benefits for both buyers and sellers.

An equilibrium state is created by ensuring that the sellers offer at competitive prices so that there is no loss for them and the buyers would buy in desperation for much higher prices. The equilibrium price becomes stable and it ensures market stability for all the participants.

In a liquid market, the prices are stable and the prices are not affected with high swings due to any large trade in the marketplace. In the illiquid market place, the condition is reversed. Here due to the low trading activity, it will create large swings in the prices of cryptocurrency. This in return, will lead to volatility and high risk for the market.

Since the prices are stable in the liquid marketplace, it can hold large orders with a huge number of market participants.

As there will be more market participants in the liquid market place the orders will be processed faster when compared to the general market place. This will lead to high-speed transactions with a large number of orders. It becomes convenient to trade cryptocurrencies in the liquid marketplace.

Technical analysis is the practice or study of the history of prices and representing the same in the graphs or charts to correlate the factors affecting the prices. Though most of them do not believe that there could be accuracy in the technical analysis of the prices, it is a widely accepted method to understand the concept of the general market. Pricing is more stable in the liquid marketplace and it helps to enhance the accuracy.

Learn the steps to start a cryptocurrency trading platform

The Important Factors Affecting Cryptocurrency Liquidity

1. Trading Volume

2. Acceptance

3. Cryptocurrency Exchange

4. Regulations

One of the important factors that affect liquidity is trading volume. Trading volume refers to the number of crypto coins traded within the past 24 hours. It depicts the activities involved by the investors to make the trade successful.

The higher the trading volume is, the better the trading activities. Most of the investors are involved to gain the price appreciation rather than using it as a medium of exchange. This may lead to volatility of the cryptocurrencies.

Cryptocurrency exchanges are the platforms to trade the cryptocurrencies between the buyer and the seller. The market activities increase with the number of cryptocurrency exchange. This, in turn, will increase the trading volume which helps to increase the liquidity of the marketplace.

Know how much does it cost to build a cryptocurrency exchange software

The currency becomes successful once it is widely accepted by all the merchants or consumers as a mode of payment. This increases the number of transactions per second. It is a fact that in the recent year’s merchants including Apple, Amazon, eBay, IBM, PayPal, Microsoft started accepting Bitcoins for online payments.

So like the traditional assets, cryptocurrencies need to be accepted to enhance the usability and benefits of cryptocurrencies as a payment mode for all business transactions. At present, around 370000 vendors deal with cryptocurrencies for online payment. They are operating in and around 180 countries in the world.

The laws and regulations involved in creating and using the cryptocurrencies may affect the liquidity of the crypto market. Some countries ban cryptocurrency trading and this may affect the liquidity of crypto marketplace. This, in turn, will impact the prices and it will shoot up to higher prices when the demand for the cryptocurrency increases. Finally, it affects the liquidity of cryptocurrency in that specific country.

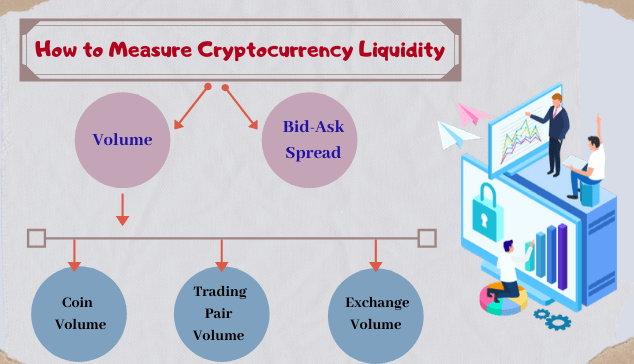

How Can We Measure Liquidity

As already discussed, trading volume plays a major role in crypto liquidity. It helps to measure crypto liquidity. The trading volume is directly proportional to trading activities. The trading patterns determine the market trends of the crypto coins. When the price of a coin falls down when the trading volume of the coin is high, it indicates that it is affected due to high volume trade than considering other factors like price manipulation.

The trading pair is actually trading between any two coins. The trading pair provides the trading volume of the pair. A coin can be traded against any other fiat currency or any other coin. For example, Bitcoin can be traded against fiat currencies like EUR, USD or any other coins like BCH, USDT, etc. This helps to determine or measure the liquidity between any two coin pairs.

Trading volume differs for each cryptocurrency exchange. It is always wise to analyze the trading volume for any particular cryptocurrency exchange volume than any coin volume. When the trading volume of the exchange increases, the trading activities also increases. This helps to measure the liquidity with that particular crypto exchange volume.

In any crypto exchange, you will be able to see the list of buyers list and sellers list. The buying price list of the buyers is called the bid price. The selling price list of the sellers is called the Ask price. When both the price meet each other at an equilibrium point, it helps to determine the market price of the coin. The bid-ask spread is calculated by calculating the difference between the highest bid price and the lowest ask price. When the bid-ask spread decreases, the liquidity of the coin increases.

Get the list of top cryptocurrency trading websites

How to Enhance the Cryptocurrency Liquidity?

It is possible to increase the liquidity of the cryptocurrency. Once it is widely accepted by all the consumers for their payment mode. It will act similar to the traditional asset and gains stability in the liquid market. However, it may contradict the concept and the standards for creating cryptocurrencies.

In order to enhance the trading volume more and more people should be able to trade cryptocurrencies. When the volume increases, the market prices will become more stable with good reserves in cryptocurrencies. In a general market, the higher orders will affect the market price and there will be swings in the market price of cryptocurrencies.

Thus by limiting the decentralization to a certain extent will limit the regulations and it can be widely accepted by all the consumers worldwide to increase the cryptocurrency liquidity exchange.

Conclusion

Hope in this article, you will be able to find the complete guide on the cryptocurrency liquidity. This article will help you to understand the importance and benefits of liquidity and the factors affecting the cryptocurrency liquidity and the high liquidity crypto exchange.

The best cryptocurrency developers will help you to build your own cryptocurrency exchange platform and thus helps to increase the trading volume, liquidity of the cryptocurrencies.

- What is Cryptojacking? Detection and Preventions Techniques

- How to Give Cryptocurrency As a Gift?

- Blockchain Development Life Cycle – Step by Step Guide

- How To Hire A Blockchain Developer For Your Company

- How to Choose the Right Bitcoin Development Company – A Complete Guide

- Common Bitcoin Scams – Beware Of Fraudsters

- How can entrepreneurs leverage blockchain in 2023?

- Role of Blockchain in Cyber Security

- Document and Certificate Verification Through Blockchain Technology

- Initial Coin Offering (ICO): Everything you need to know in 2023

- Categories

- Azure Blockchain Service

- Bitcoin

- Bitcoin Development

- Blockchain Application

- Blockchain Application Development

- blockchain developer

- Blockchain Development

- common bitcoin scams

- Crypto software features

- Crypto softwares

- Cryptocurrency

- Cryptocurrency Development

- Cryptocurrency Exchange Software Development

- Cryptocurrency review

- Cryptocurrency Trading

- Cryptocurrency Wallet Development

- ERC20 Token Development

- Hashing Algorithm

- ICO Development

- ICO Development Service

- ico website development

- Proof of Stake Coins

- Smart Contract Development

- Uncategorized

Complete guide on the cryptocurrency liquidity and it was very informative Thanks for sharing the same!